Accounts Receivable supports multiple ship to addresses defined against a single customer. Tax codes on sales orders can then update appropriately depending on the shipping location for the customer.

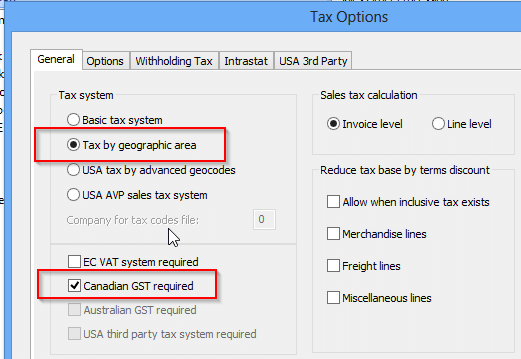

To set up multiple shipping addresses, first go to Tax Options and select Tax by geographic area and Canadian GST required.

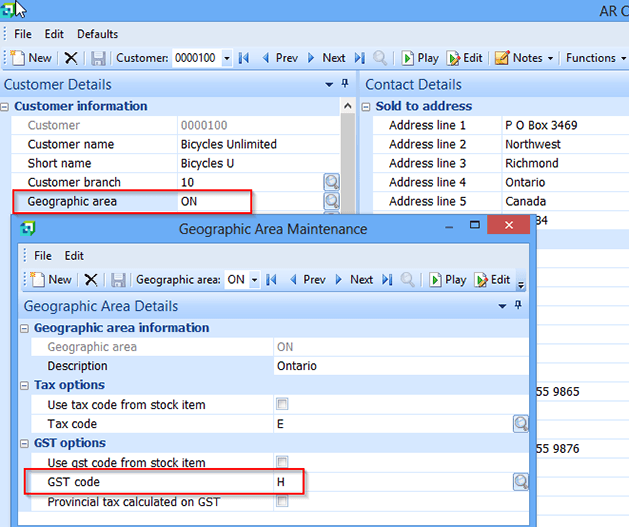

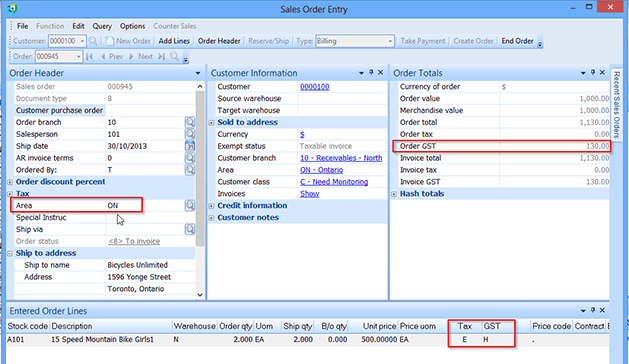

Now, in Accounts Receivable, we have a customer located in Ontario, subject to HST of 13%.

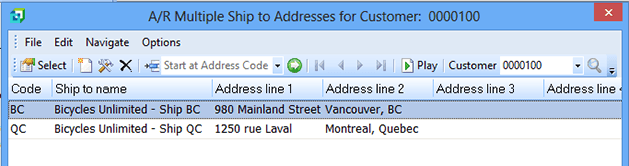

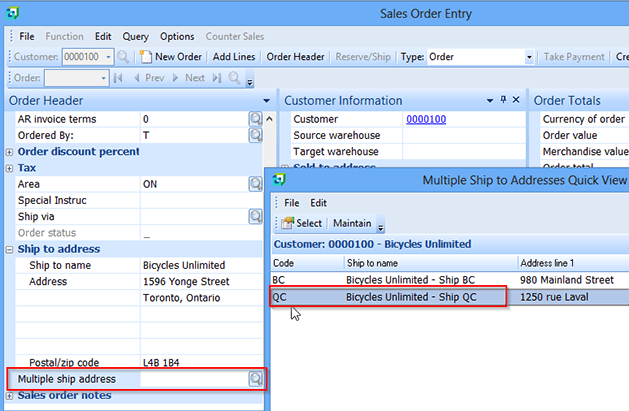

They have two other locations in Canada, one in Quebec and one in British Columbia, and we have added shipping addresses to this customer in Accounts Receivable.

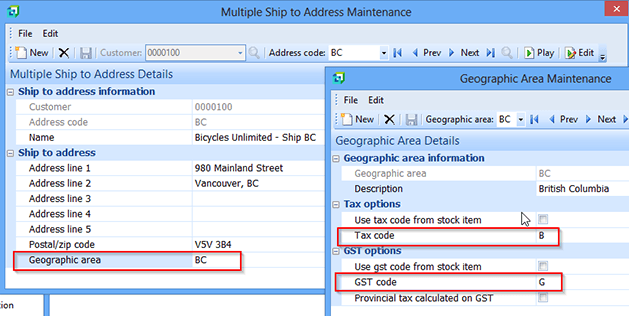

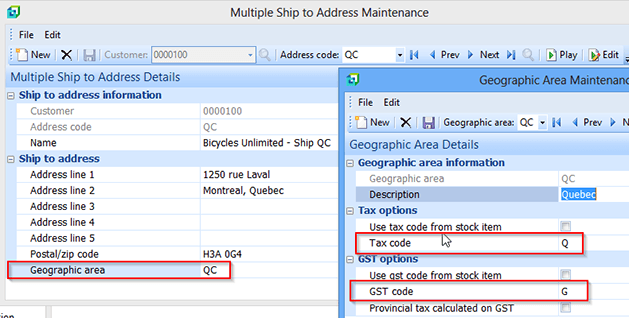

Against each Multiple Ship to Address, we can specify a different geographic area with its own tax codes.

Here we have the BC ship to address with a Geographic area of BC, a Tax code of B, and a GST code of G.

Here we have the Quebec ship to address with a Geographic area of QC, a Tax code of Q, and a GST code of G.

In Sales Order Entry, if I add an order for this customer, by default, it will pick up the customer’s geographic area of ON (Ontario) and the respective HST rate of 13%.

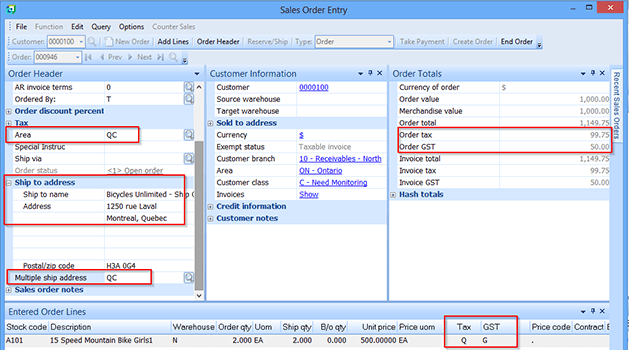

If, for the same customer, we ship goods to their Quebec location and need to invoice QST & GST, we need to use the Multiple Ship address field.

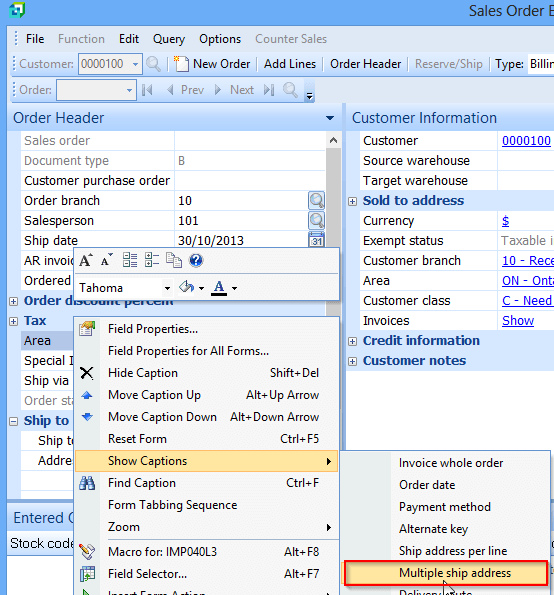

First, you may need to show the Multiple ship address field in the Sales Order Entry screen.

Open Sales Order Entry and right click on Ship to address and select Show Captions -> Multiple ship address.

Then under Multiple ship address, select the desired address. We are shipping to Quebec in this example.

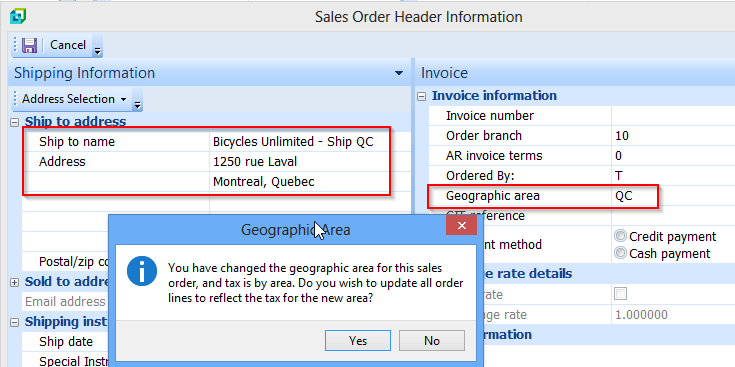

You will then get following pop-up saying you have changed the geographic area for this sales order and tax is by area. Do you wish to update all order lines to reflect the tax for the new area?

When you select Yes, the Ship to address updates to the Quebec location, and the Geographic area changes to QC (Quebec).

The sales order now shows Area = QC and Tax is set to Q for QST at a 9.975% rate and GST is set to G for GST at a 5% rate. All Order Totals update as approriate.

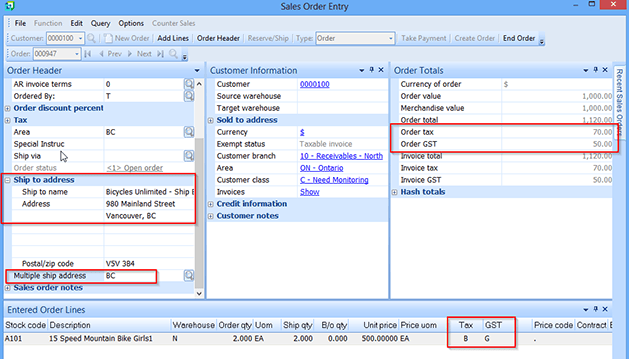

Here is an example of the same Ontario customer using the Ship to address from British Columbia with Multiple ship address set to BC, Tax code set to B for BC Sales tax (7%), and GST code set to G for GST (5%).